We’ve put together the most frequently asked questions on the Government’s Streamlined Energy and Carbon reporting (SECR) scheme, to help you meet compliance.

Streamlined Energy and Carbon Reporting (SECR) is a mandatory scheme that applies to large UK companies. Businesses within scope must collect information relating to their energy use and associated carbon emissions, then submit this as part of their annual reporting to Companies House.

SECR came into force on 1st April 2019.

SECR applies to three different types of companies:

- Companies listed on a stock exchange (“quoted companies”)

- Companies that aren’t listed on a stock exchange but meet the Companies Act definition of “large”

- Limited Liability Partnerships (LLPs) that meet the definition of “large”.

The Companies Act 2006 defines large companies as those that meet at least two of the three following criteria:

- Turnover of £36 million or more;

- A balance sheet total of £18 million or more;

- 250 employees or more.

Yes. If a business is registered outside the UK, it is exempt from SECR. This includes overseas parent companies with UK subsidiaries.

No. The SECR regulations apply across the UK.

There are currently 11,300 UK businesses in scope of SECR, according to the most recent published estimate from the Department for Business, Energy and Industrial Strategy (BEIS).

SECR reporting is done as part of your annual returns to Companies House, so it is aligned with your company’s financial year (which may be different from the UK tax year). It will be due when your next annual report is due. Businesses that have been in scope of SECR since it came in will now be in their third year of collecting energy and carbon data.

No. Organisations are encouraged to align all information with financial years, “to aid comparability and consistency of information across reports and organisations”, but it is not compulsory.

If the annual period your organisation chooses for its SECR reporting is not the same as its financial year, you should make this fact clear in the report.

The obligation under SECR is to disclose annual figures for emissions and energy use, so your SECR reporting period should still be 12 months.

However, BEIS suggests that organisations with an 18-month financial year could also publish an 18-monthly version of their energy and emissions data, to align with their financial year. It is thought that this will “aid comparability and consistency of information across reports and organisations”. This would be additional to your annual SECR reporting obligations, not a replacement for it.

The Streamlined Energy and Carbon Reporting regulations were drawn up before the UK government made its legally binding commitment to reach net zero by 2050. But one of the aims of SECR is to help companies reduce their carbon emissions by making them more aware of what they emit and why.

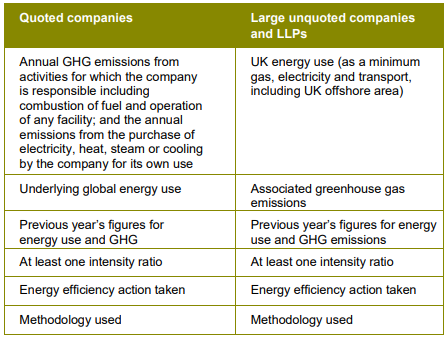

The rules vary depending on the type of company. The biggest difference is that quoted companies have to calculate and report all greenhouse gas emissions the company is responsible for, globally. They must also report all the underlying energy use that was used to calculate the figure for GHG emissions.

Large unquoted companies and LLPs just have to report on their UK energy use and associated emissions. (See next question for more detail on the differences.)

All types of business must also include:

- The previous year’s figures for greenhouse gas emissions and energy use.

- At least one intensity ratio (showing their emissions in the context of another metric, such as tonnes of CO2e per thousand products manufactured).

- What action they are taking to become more energy efficient.

- The methodology used to do the calculations for the report.

There are seven different greenhouse gases recognised as contributing to climate change:

- Carbon dioxide (CO2)

- Methane (CH4)

- Nitrous oxide (N2O)

- Hydrofluorocarbons (HFCs)

- Perfluorocarbons (PFCs)

- Sulphur hexafluoride (SF6)

- Nitrogen trifluoride (NF3)

It is compulsory to include all of these in your SECR reporting.

All types of company should submit their SECR report to Companies House.

For quoted and unquoted companies, SECR reporting should be included in their annual directors’ report.

For charitable companies, it should be in the combined directors’ and trustees’ annual report.

LLPs have to prepare an energy and carbon report (a new obligation that was brought in with SECR). This should be submitted with their annual accounts. It must be approved by the members and signed by one designated member on behalf of all the others.

There are several possible exemptions.

- If you are reporting at group level and a subsidiary would not fall in scope of SECR if reporting on its own account, you can choose to leave out the energy and carbon information relating to that subsidiary.

- If your organisation has consumed 40MWh or less of energy during the relevant financial year, it qualifies as a “low energy user” and this means you do not have to provide all the detailed information required in a SECR report. You do still have to calculate the organisation’s total energy use (including gas, electricity and transport fuel) to be sure that the organisation falls below the threshold. Your directors’ report should state that this is the reason why you are not providing a full SECR report.

- If your company’s energy and carbon information is either genuinely commercially sensitive or truly impractical to obtain, you can apply for an exemption on these grounds too. But you will need to explain why.

Organisations that are officially defined as public bodies do not fall in scope of SECR, but may have other carbon reporting obligations such as the Greening Government Commitments.

However, not all organisations providing a public service are defined as public bodies. A company might still fall in scope of SECR even if it is owned by a university or NHS trust and/or carries out exclusively not-for-profit activities.

If you are unsure about your reporting requirements, get in touch.

If a subsidiary is big enough that it would fall in scope of SECR as a company in its own right (because it counts as a quoted company, large unquoted company or large LLP) then group-level SECR reporting must include information relating to this subsidiary. But, as we explained in the list of exemptions above, if it is too small to fall in scope of SECR in its own right, the group does not need to report on its behalf.

If you’re reporting at subsidiary level and your energy and carbon information has already been included in the group-level report, you’re not obliged to report it in your own accounts and reports.

It is not currently mandatory to include renewable energy consumption and associated emissions in your SECR reporting, but it is encouraged. This is because even if a business is on a “100% renewables” energy tariff, electricity supplied from the grid is a mix that the individual business cannot control.

The guidelines recommend that for your SECR reporting, you calculate emissions based on the average emissions for the grid in your region (the so-called “location-based” approach) rather than basing them on your company’s choice of tariff. But if you are on a 100% renewable tariff, you should explain this in your reporting too. This “dual reporting” approach reflects the reality of grid consumption while acknowledging the organisation’s efforts to support renewable generation through its choice of supply.

The government is currently working on a shake-up of how green electricity tariffs are labelled, so this guidance may change in 2022 in response to greater transparency in the market.

If a business buys renewable electricity through a power purchase agreement (PPA) or chooses to “green” its grid power through buying Renewable Energy Guarantees of Origin (REGO) certificates, the guidance recommends a “market-based” reporting approach. This means reporting on the actual emissions from your generation source. As with a supplier tariff, the guidance recommends a “dual reporting” approach where you also include the grid-average figures for your region (the “location-based” approach) so that the two sets of figures can contextualise each other.

You should also specify how the PPA works. Is the generation project on-site? Does it supply your business directly?

The same “dual reporting” approach that the guidance recommends for green electricity (see previous two questions) is also recommended for green gas, or biomethane.

Possibly. The Government is formally required to review the SECR regulations within five years of them coming into force, i.e. by 1 April 2024. But, as mentioned in the response to a recent consultation on mandatory climate-related financial disclosures, the government is considering whether to implement changes to SECR in 2023. Any change would be subject to consultation.

No. SECR was brought in by UK legislation that has nothing to do with the EU. This is why companies incorporated outside the UK are not required to follow it, and why Brexit did not change anything about SECR.

Companies in scope must include at least one intensity ratio in their SECR reporting.

An intensity ratio is a way of defining your emissions data in relation to an appropriate business metric, such as tonnes of CO2e per sales revenue, or tonnes of CO2e per total square metres of floor space. This allows comparison of energy efficiency performance over time and with other similar types of organisations.

SECR intensity ratios are calculated by dividing your emissions by your organisation-specific metric.

The government’s environmental reporting guidelines give plenty of examples of common intensity ratios. While organisations are free to choose their own intensity ratio, these should be most appropriate to your business activity, e.g. tonnes of CO2e per total million tonnes of production for the manufacturing sector. They should also be calculated on a consistent basis year on year, with the method of calculation disclosed, and meaningful to stakeholders.

Organisations in scope of SECR should report all energy use and associated GHG emissions that they are responsible for. In the case of landlord/tenant arrangements, the party responsible for the consumption of energy should take the responsibility for reporting of it.

So, as a tenant (for example in a rented serviced property) – even if you are not directly responsible for the purchase of your energy, it is your responsibility to report on it.

Information on your energy consumption may be available through sub-meters, or you may need to provide estimates where information is not available.

It depends on how much financial or operational control your company has over its franchise.

A franchise is a separate legal entity usually not under the financial or operational control of the franchiser, which gives the franchise holder rights to sell a product or service.

In this case, emissions from your franchise are considered to occur at sources that you do not control: in reporting terms they are known as indirect, or Scope 3 emissions. It is voluntary to report these under SECR, but is strongly encouraged, according to the government’s official guidance.

It gets a bit more complicated if you have significant financial or operational influence over your franchises – as it could be argued that you have control over t heir emissions too. If you are a franchisee/franchiser looking for advice, get in touch.

Yes. If a member of staff is claiming back the cost of fuel for business-related travel, it should be included in your SECR reporting, whether they are driving their own car or a company car.

Staff travel for the purposes of commuting to work, that they pay for themselves, is different and does not come under SECR.

Your calculation of energy consumption and associated emissions for the purposes of travel should include the following:

- Fuel used in company cars on business use.

- Fuel used in fleet vehicles which you operate on business use.

- Fuel used in personal/hire cars on business use (including fuel for which the organisation reimburses its employees following claims for business mileage).

- Fuel used in private jets, fleet aircraft, trains, ships, or drilling platforms which you operate.

- Onsite transport such as fork-lift trucks.

The following activities are not required to be included in your calculation of your total energy consumption but may be reported separately (including as part of Scope 3 emissions):

- Fuel associated with train travel of your employees where you do not operate the train.

- Fuel associated with flights your employees take where you do not operate the aircraft.

- Fuel associated with taxi journeys your employees take where you do not operate the taxi firm.

- Fuel associated with transportation of goods where you subcontract a firm or self-employed individual to undertake this work for you.

No, but it is encouraged.

Emissions from employee home working are classed as “Scope 3” emissions – that is, they occur as a consequence of an organisation’s activities, but aren’t owned or controlled by that organisation.

For large unquoted companies and LLPs, it is voluntary to report on most Scope 3 emissions, including those from home working. For quoted companies, all Scope 3 reporting is voluntary. But as businesses increasingly encourage more staff to work from home where possible, it is useful for your company’s net zero goals to have an idea of the emissions involved.

Page 27 of the current government guidance for SECR has a handy table showing the different requirements.

For more detail on the differences in reporting requirements, read our blogpost: SECR: What’s the difference between reporting requirements for quoted and unquoted companies?

Page 27 of the current government guidance for SECR has a handy table showing the different requirements.

For more detail on the differences in reporting requirements, read our blogpost: SECR: What’s the difference between reporting requirements for quoted and unquoted companies?